US inflation could take longer to reach the Fed's 2% target

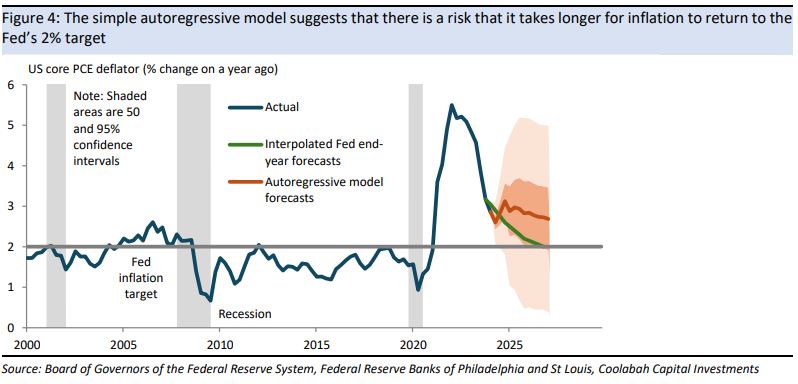

A simple model points to a risk that US inflation takes longer to return to the 2% target than expected by the Fed because inflation dynamics have not returned to pre-COVID patterns, where the issue largely rests with services prices. This risk should not be overstated as dynamics could improve further, but is consistent with interest rates staying high for longer.

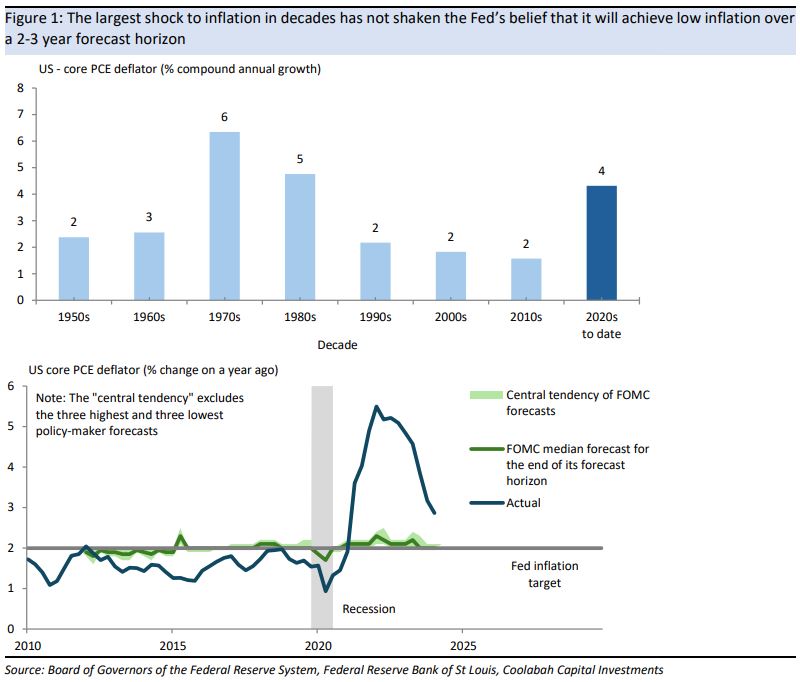

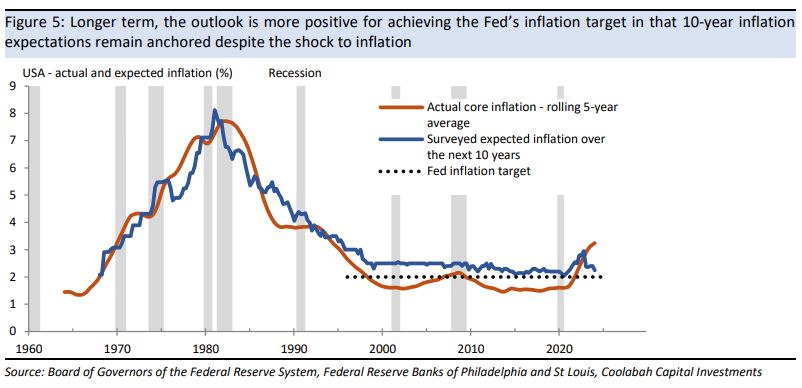

One of the great successes of the Federal Reserve was bringing the high inflation of the 1970s and 1980s under control and locking in low inflation over the 1990s, 2000s, and 2010s.

COVID challenged that success in the 2020s, with inflation surging to its highest level in decades.

Inflation has quickly subsided as global supply chains have normalised and goods prices have fallen, but remains above the Fed’s 2% target thanks to still-high services inflation.

The Fed believes that the current level of interest rates is high enough to return inflation to target by 2026, although the unexpected resilience of the US economy suggests that policy may not be as tight as widely thought.

However, history shows that the Fed almost always believes that it will achieve its inflation target in two or three years’ time, at least since it formally started targeting 2% inflation in 2012.

Over this time, the median FOMC forecast for core inflation by the end of the FOMC’s forecast horizon has nearly always been 2%, with the largest deviation being plus or minus 0.25pp.

Even COVID failed to shake this confidence, with the Fed continuing to expect a return to low inflation over its 2-3 year forecast horizon.

Recently, inflation has been higher than expected, derailing the Fed’s plans to start cutting rates next month and adding to the uncertainty over whether inflation might take longer to return to 2% than forecast by the FOMC.

This uncertainty is often connected to doubt over whether the neutral rate has increased from pre-pandemic levels, such that policy might not be tight enough to attain 2% inflation by the end of 2026, particularly when the Fed’s own analysis suggests that inflation is not overly sensitive to high interest rates.

Rather than revisit the debate over the neutral policy rate, we have taken an alternative approach in exploring the risk that inflation stays higher for longer by analysing inflation dynamics.

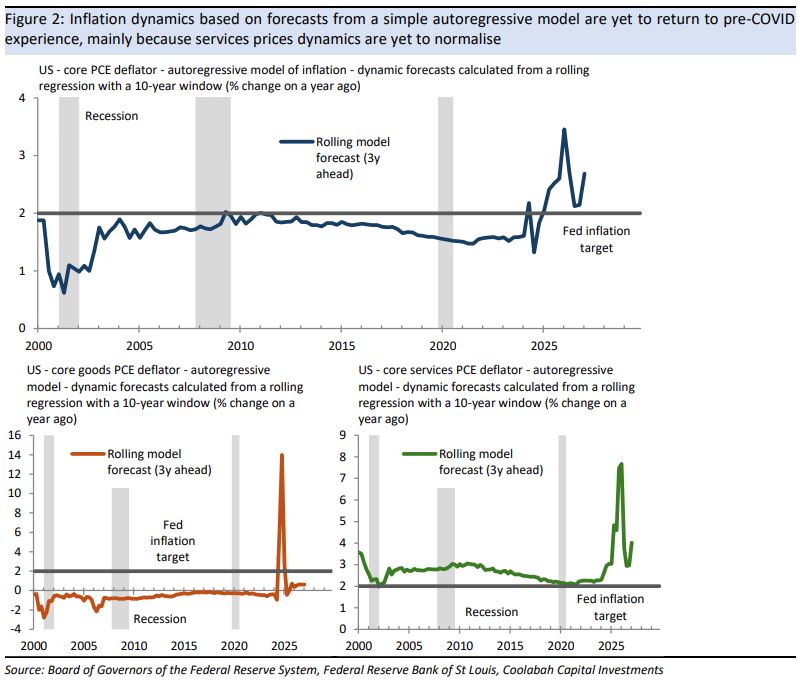

This involved extending some Fed work on the persistence of inflation by analysing how the forecasts of a simple model of consumer prices evolved over time.

The model was an autoregressive model that specified current inflation as a function of inflation over the past year.

The model was used to generate “real-time” forecasts of inflation, calculated by estimating the model over a 10-year window that was rolled through the data one quarter at a time.

Forecasts were calculated up to three years ahead, a period that broadly matches the FOMC’s forecast horizon.

On this metric, the forecasts suggest that inflation dynamics changed for the worse during COVID, following many years where they pointed to below-target inflation.

Inflation dynamics have improved over the past couple of years, but currently point to core inflation staying above the Fed’s 2% target for the next three years.

Replicating the analysis for the goods/services split of core inflation, inflation dynamics for goods prices are almost back in line with pre-pandemic patterns.

The same isn’t true for services prices, which still show unfavourable dynamics.

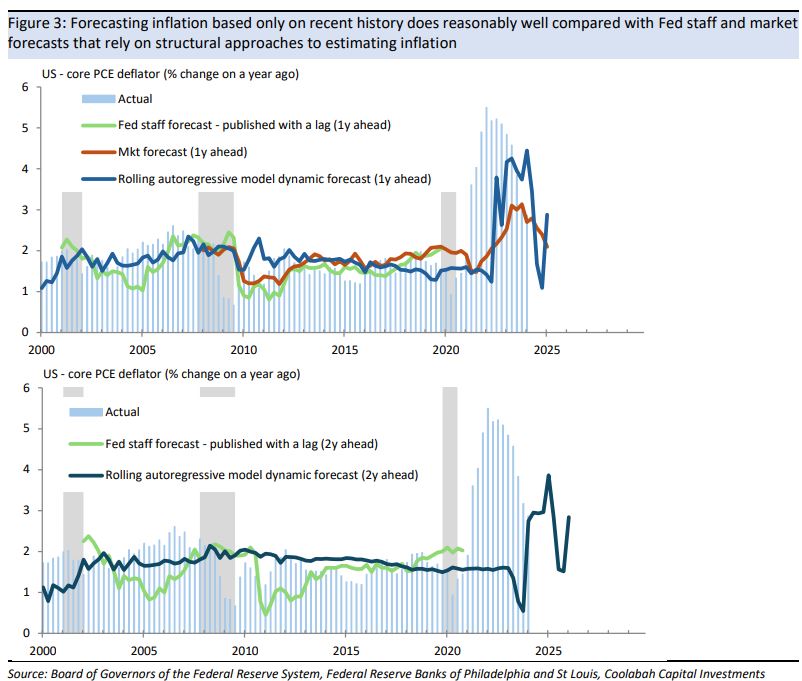

The obvious criticism of this analysis is that modelling inflation purely as a function of recent history provides only a limited perspective on inflation dynamics.

After all, the Fed and many market economists forecast inflation using more sophisticated approaches – such as forecasting inflation based on expected inflation and spare capacity in the labour market – supplemented by information from business surveys in the near term.

However, a comparison of the model’s “real-time” forecasts with both Fed staff forecasts – which are published with a long lag – and market forecasts suggests that the autoregressive specification does a better job than might have been expected.

Forecast errors are often large, especially since the onset of COVID, but the model forecasts beat the market’s 1-year ahead forecasts about 55% of the time and outperform the Fed’s 2-year ahead forecasts about 60% of the time despite underperforming at a 1-year horizon.

This might seem surprising, but likely reflects the inherent difficulty in forecasting the inputs – such as output, unemployment and inflation expectations – that are required by more structural approaches to estimating inflation.

Given that these comparisons suggest the autoregressive model has some value in forecasting inflation, it currently suggests that inflation will still be in the high 2s over the next few years, above the Fed’s 2% target.

This is a fluid situation, though, and it is important to remember that inflation dynamics are still changing and could become more favourable over the coming year, with large confidence intervals around the model’s forecasts.

Although we did not extend the analysis to beyond the short to medium term, so far the indications are still that inflation will eventually return to target given long-term inflation expectations remain anchored despite the shock to actual inflation.

5 topics